What Is Investment?

Have you ever found yourself wondering what all the fuss about investment is? It is essentially putting money into a business to get money from it. Even if you have studied business your entire life, a lot of the investment jargon can still be quite intimidating. I know it is for me, which is why I have compiled a list of 8 basic investment terms, as well as bonus resources, to help you get started. To see definitions for some of these terms, you could check out this glossary of investment terms by JP Morgan Asset Management.

You might already be familiar with some of these terms, while others may seem to be confusing or a bit daunting. Regardless, it might prove to be very helpful for you, so let’s get started!

Stocks

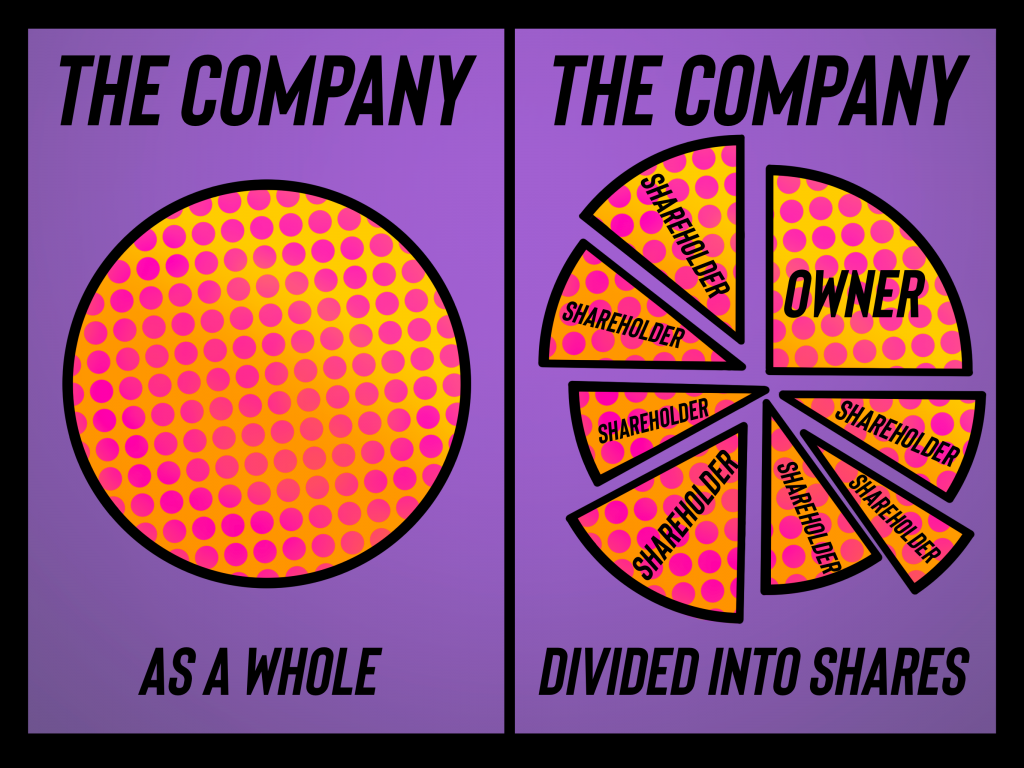

If all basic investment terms were letters of the alphabet, then stocks would’ve been A. So, whenever you look up investment, you have to come across this term. Think of it this way: when a business decides to go public, it enables general people or other companies to buy ownership of a portion of the entire business. The portion they end up buying is referred to as stocks or shares. Shareholders are individuals or an entity who own stocks or shares of the company. The diagram below might help you to understand it better.

Dividends

You can judge a company’s performance based on its share price. Hence, it has been performing well, the value of the stock is likely to rise and vice versa. This is because, if a company performs well, more individuals would want to invest in it, resulting in higher share prices.

You might wonder, why would anyone want to invest and buy stocks? The answer to this is that there must be an incentive for them to do so. Dividends are payouts to shareholders based on the profit earned by the company. In other words, shareholders are paid dividends for their investment in the company. Firms generally pay dividends quarterly but this could vary. The amount paid to each shareholder depends on the proportion of shares they have in the company. It is an additional source of income for shareholders and so, it acts as an incentive for potential shareholders to invest in the company.

Stock Exchange

A stock exchange facilitates the interaction of investors with companies, enabling them to trade. To put it simply, it is where you can buy and sell shares. These exchanges aid companies in raising capital through investment which can potentially result in higher profits, thereby benefiting investors as well with dividends. Examples include the National Association of Securities Dealers Automated Quotations (NASDAQ), the New York Stock Exchange (NYSE) and the London Stock Exchange (LSE).

Ticker Symbol

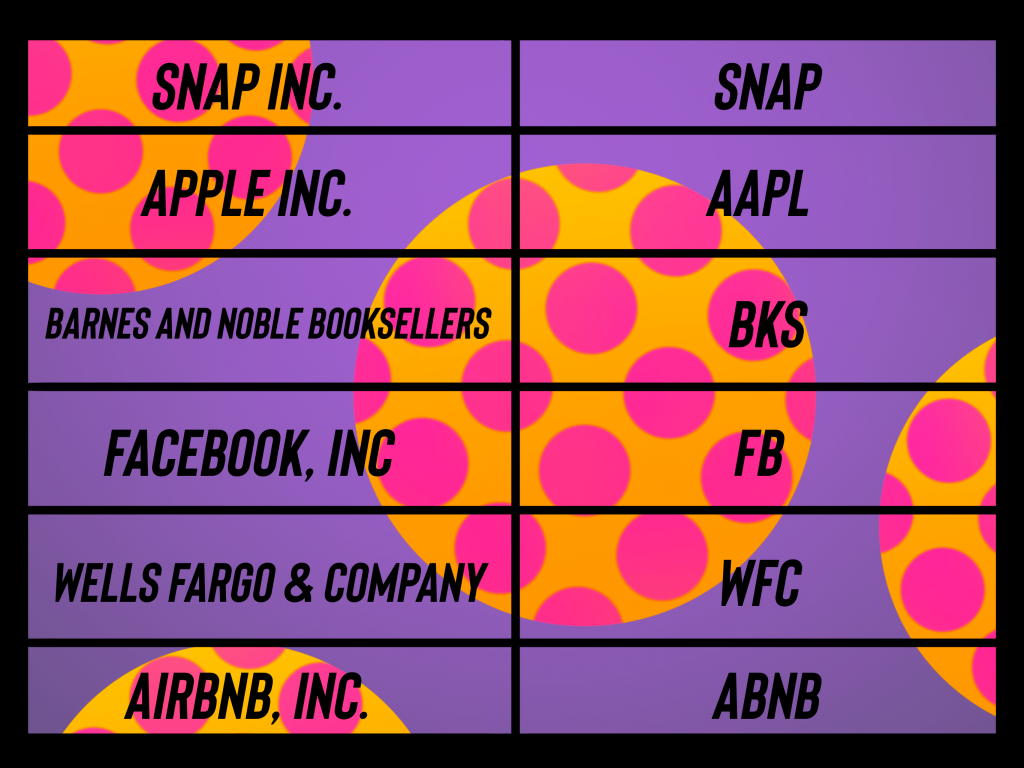

If you look up stocks of any company listed in the stock exchange, you are likely to come across it’s ticker symbol. A ticker symbol or stock symbol indicates the company that’s issuing shares. It usually comprises less than four or five letters and may even contain numbers. The table below contains examples of companies and their ticker symbols.

Bonds

A bond is simply a loan to the government or an organisation. As the issuer of the loan, the government or the organisation would pay you back the money you’ve loaned to them at a specified date, as well as pay interest on the amount at specified intervals. Prices of bonds are inversely proportional to interest rates. Therefore, as interest rates rise, the price of bonds fall and vice versa.

Interest

Interest is the cost of borrowing money and is charged as a percentage. It gives lenders an incentive to let individuals borrow money as the interest on it would be income for them. Using a simple interest formula or a compound interest formula, you can calculate the amount of interest the borrower would have to pay.

Recall your high school math classes. Does simple interest and compound interest ring a bell? It’s okay if it doesn’t, we’ve got you covered!

Simple Interest

Simple interest is calculated on the amount of money that has been loaned. The formula is:

I = PRT/100

where I = Interest, P = Principal Amount, R = Rate of Interest, T = Time

Compound Interest

Compound interest is calculated on the principal amount and the interest on it. As the name suggests, the amount of interest compounds or accumulates overtime. The formula is:

I = P(R+1)T – P

where I = Interest, P = Principal Amount, R = Rate of Interest, T = Time

Why Should You Invest?

There are countless other investment terms that one needs to know. However, now that you know the basics, let’s talk about why you should invest. An important reason could be to increase your wealth. By investing and having shares in companies, you’re giving yourself another income stream to fall back on. This could be beneficial for you when you retire or have a huge expense coming up.

Investment Terms: Bonus Resources!

Again, learning about investment and then actually investing can be quite intimidating. That’s why I have added bonus resources that you could use for your understanding. You could look things up on your own but the Internet is not always the best place to get educated on something. Hence, it’s always best to have a certified financial advisor to help you in your investment journey.

Podcasts To Listen To:

The Investing for Beginners Podcast – Andrew Sather & Dave Ahern

This is one of my favourite business podcasts! Hosts Andrew Sather and Dave Ahern break down investment jargons and more to guide you in your investment journey. You can browse through several podcasts from 2017 till now depending on whatever you wanna learn more about.

Financial Feminist – Tori Dunlap

Tori Dunlap hosts this relatively new podcast on “how to make more, spend less and feel financially confident in a world run by rich white men.” It has a 5-star rating on Apple Podcasts with over 2400 ratings. I haven’t had a chance to give this a listen yet but if you do, let me know what you think in the comments!

Books To Read:

“Broke Millennial Takes On Investing: A Beginner’s Guide to Leveling Up Your Money” – Erin Lowry

As its name suggests, this book is mainly aimed at millennials who are just getting started in their own investment journey. A lot of reviews say that it is truly the ideal book for beginners so rest asured, this is the ideal book for you too!

“How to Make Money in Stocks: A Winning System in Good Times and Bad” – William J. O’Neil

O’Neil breaks down what investment is all about and helps readers with how to pick the best stocks, bonds etc. This might not be as beginner friendly as the previous one, but it’s definitely worth a read.

I hope this was insightful for you. Let us know in the comments if you’d like to see more of these here and be sure to subscribe to our newsletter!

Leave a Reply